LITEON Tax Policy

The Tax Policy is approved by the Chairman.

Overview

LITEON takes priority and great effort in complying with local tax regulation of countries in which the Company and its subsidiaries operate in. Our tax policies are set based on and reflective of our business operations around the world.

Over the course of years, LITEON has implemented conservative tax policies, ensuring that these reflect our business activities and align with local tax regulations. Presently, the Company conducts operations in many countries and pays taxes as per local Tax Acts.

Tax Strategy

LITEON takes priority and great effort to comply with local tax jurisdictions in which the Company and its subsidiaries operate. To effectively mitigate the risks highlighted above and to ensure tax compliance in all tax jurisdictions, our approaches are as follow:

Complying with local tax regulations and disclosure requirements with due care;

Enhancing the values created for shareholders by maintaining sound reputation as responsible tax citizen;

Sustaining strong technical expertise through continuous development of talents; and,

Executing effective risk management and control on continual basis.

Not engaging in tax avoidance schemes by using tax restructures and tax havens.

Not engaging in intentionally profits transfer to low tax jurisdiction where there is little or no economic activity.

Intercompany Transactions

LITEON applies arm's length principle to intercompany transaction and undertakes measures to ensure that the involving parties of these transactions are reasonably remunerated on the basis of functions and risks assumed, thus applying proper transfer pricing methods. Furthermore, transfer pricing documentations are prepared for these intra-group transactions and in accordance to local requirements of countries in which the involving respective subsidiaries are situated in.

Tax Risks

LITEON has a full-time tax unit under Finance Department in place to

handle tax management related matters, such as tax administration

and tax risk management. The tax unit reports regularly to the top

management on tax management practices and results in order to keep

the management team up to date on implementation of the company's

tax policy.

Regarding tax risk, LITEON has offices worldwide that are exposed to tax

risk and complicated tax compliance issues. In addition to a professional

team of tax experts that coordinate planning and perform tasks, LITEON

hires external tax consultants to provide assistance as needed.

LITEON's risk management mechanisms

LITEON complies with local tax regulations applicable to its offices.

LITEON works with local tax authorities on the principle of fair taxation,

and install channels for effective communication. Meanwhile, LITEON

follows local regulations and complete filing procedures and pay taxes

as required. If a local tax authority raises a question, LITEON always

makes the best effort to provide answers and necessary documents.

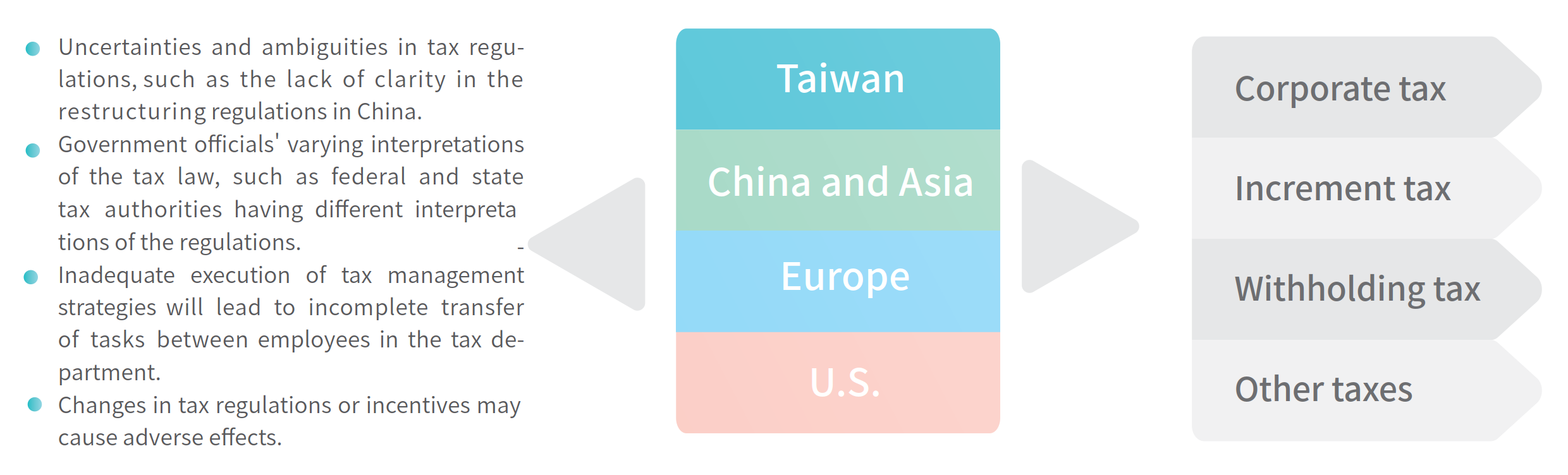

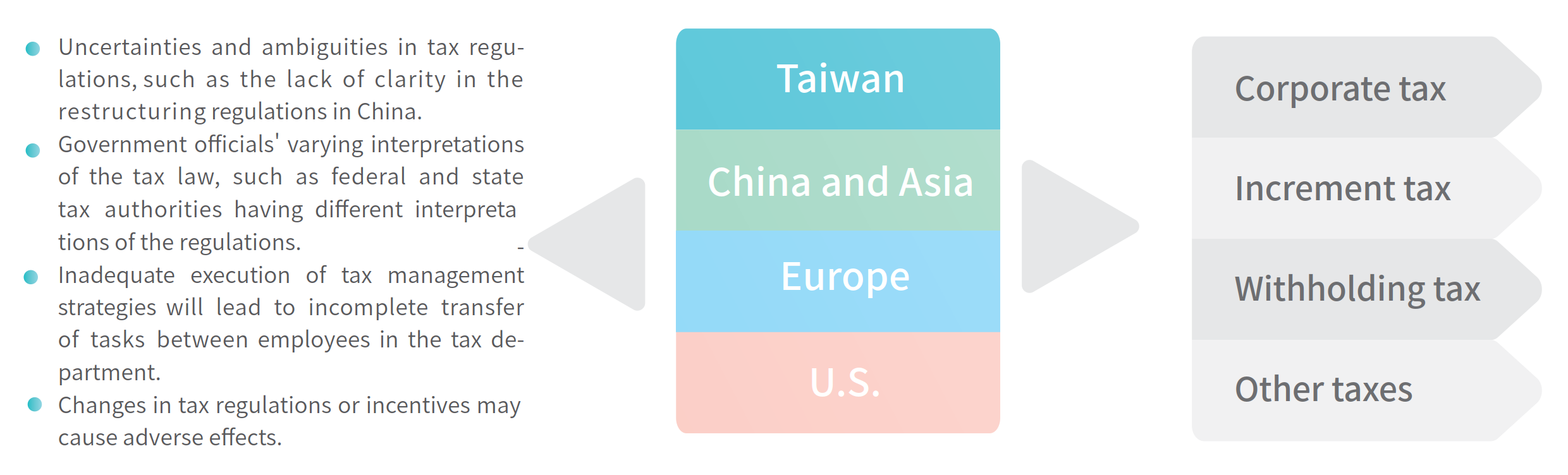

Typically, tax risks are likely to arise from situations such as unclearness and ambiguity in tax regulations (i.e. lack of clarity in China's tax treatment relating to group re-organization), different interpretations of tax regulations by governing officials (i.e. opinions of state-level and federal tax authorities often differ), ineffective implementation of tax management strategy as result of incomplete work transition between tax function members, and potential adverse impacts as result of changes in tax regulations or incentive programs.

Moreover, the above mentioned risks generally might affect companies' tax liabilities, including but not limited to corporate income tax, value-added tax, withholding tax, and other taxes, as depicted below:

Tax Status

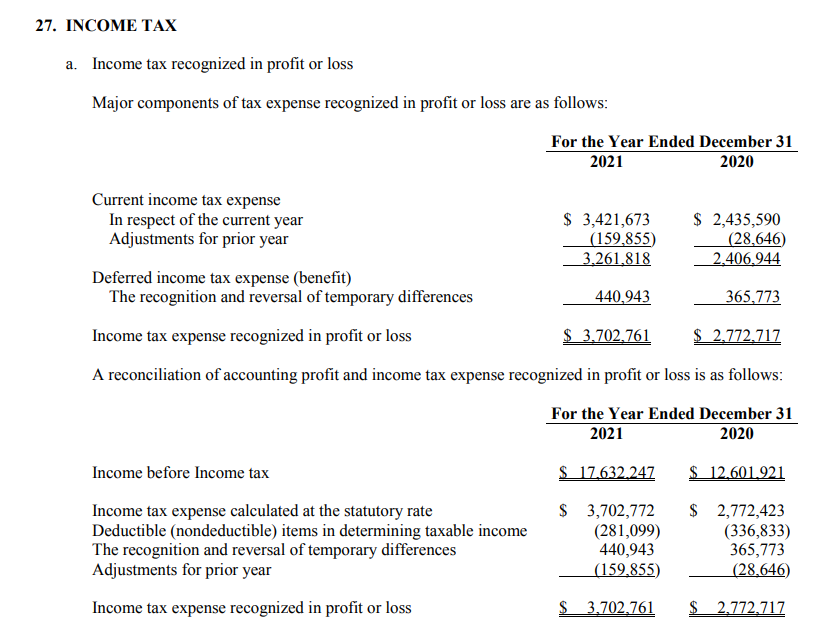

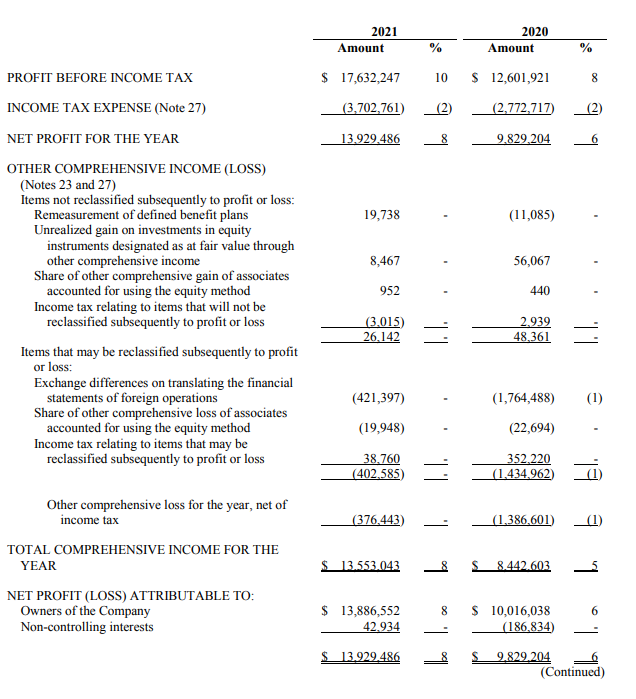

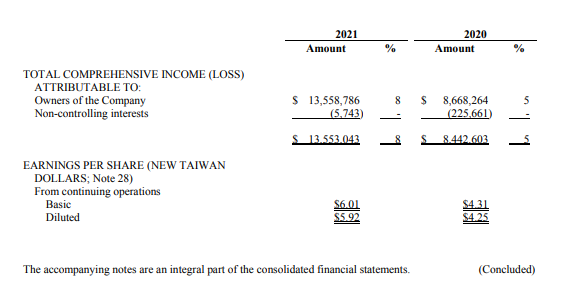

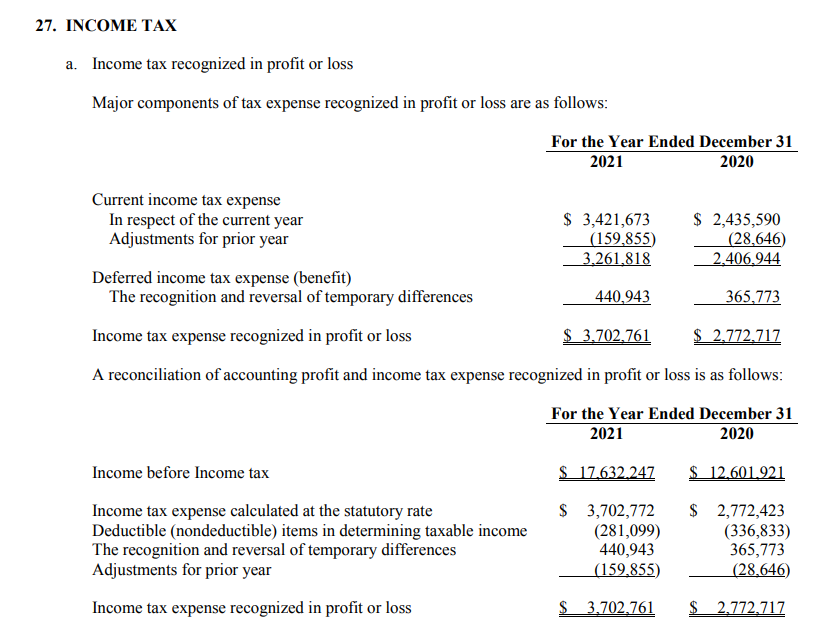

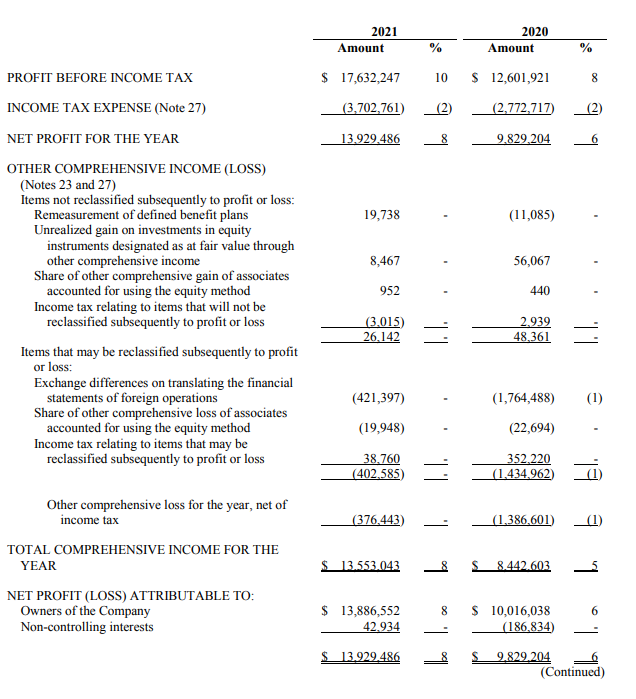

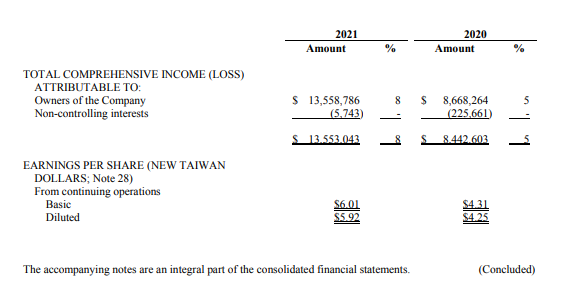

LITEON Technology Corp. is a Taiwanese company listed on Taiwan Stock Exchange. The Company applies International Financial Reporting Standards as adopted by Taiwan. In brief, enclosed below are the latest released tax information, including breakdown of income tax expenses as well both deferred tax liabilities and assets (as of 2021/12/31 consolidated financial statements).

#### Income Tax

Income Statement

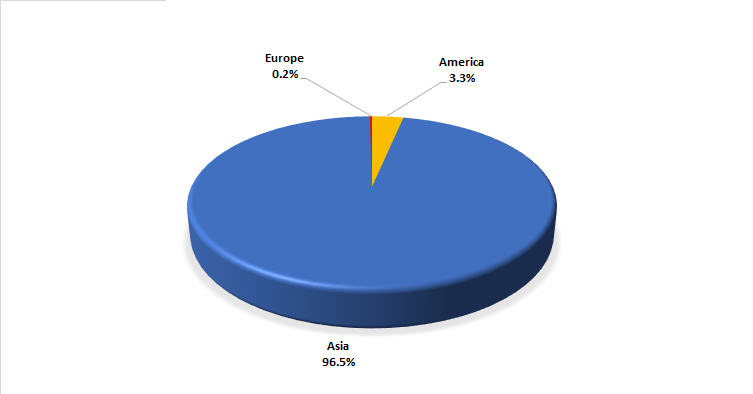

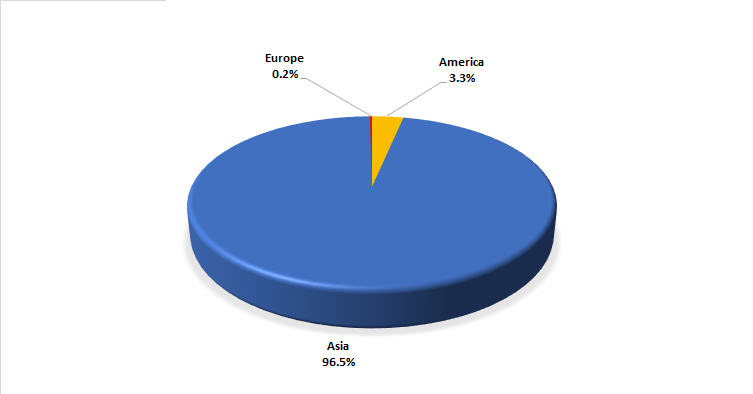

Income Tax Expenses by Region

Note:

- Asia: Taiwan, China, Hong Kong, India, Japan, Jordan, Korea, Malaysia, Philippines, Singapore, Thailand, and Vietnam

- America: Brazil, Mexico, and United States

- Europe: Finland, Germany, Netherlands, and United Kingdom

Sustainable Governance▸

言語を選択する